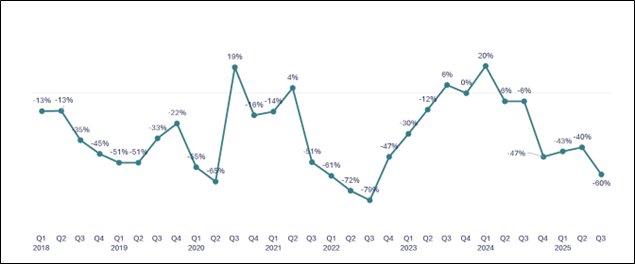

Food manufacturers reveal Budget concerns, as confidence plummets to -60%

- Business confidence amongst food and drink manufacturers dropped to -60% in the third quarter of 2025, down from -40% in Q2

- 90% feel pessimistic or nervous about the Government’s upcoming Budget – with 88% particularly concerned about the impact of additional taxes or business costs

- FDF is calling for Government to restore business confidence by ensuring no further burdens are added in the upcoming Budget and partnering with industry on a long-term plan to drive investment into our sector to unlock £14bn of growth

Business confidence among food and drink manufacturers has taken another dip, plummeting to -60% in Q3 20251, down from -40% in the previous quarter. This marks the sixth consecutive quarter of negative confidence, which dramatically fell after last year’s Budget, has remained weak since, and now taken another concerning hit2.

Graph – Food and drink manufacturers’ confidence

Industry’s top Budget concerns

Uncertainty over taxes and a lack of regulatory clarity, alongside relentlessly rising costs seem to be the drivers of depressed confidence. The Food and Drink Federation’s (FDF) latest State of Industry report reveals that 90% of food manufacturers are feeling pessimistic or nervous about the upcoming Budget.

Industry’s top concern is the prospect of additional taxes or costs for the sector (88%), while half (50%) are concerned about the risk of more burdensome regulation. Meanwhile, more than two fifths (45%) are concerned about new policies that will negatively impact household finances, given that volumes of food sales are already 8.3% lower than in September 2019.

Inflationary pressure remains

With production costs having risen 5.0% in the last 12 months1, food inflation has remained stubbornly high in 2025 and is forecasted to remain elevated through 2026. With energy and ingredient costs stabilised, this is being driven by a tranche of regulatory pressures, including a £1.1bn bill for the new EPR packaging tax and changes to National Insurance Contributions (NIC), which manufacturers have been left with no choice but to pass costs on to shoppers. Energy bills remain high, and some companies are facing significantly higher rates bills too.

In response to the increased employment costs introduced in last year’s Budget, two thirds of businesses (66%) have already or will be reducing headcount. Three quarters (74%) of businesses have had to pass on some costs to consumers and over a quarter (26%) are no longer creating new roles3.

Investment being hit

Meanwhile, worryingly, almost a third (29%) reduced or cancelled plans to invest in the UK to cover these costs. With growth, investment and the development of new skilled jobs being held back by regulatory pressures, two fifths of manufacturers (40%) are understandably concerned that there won’t be policies to drive growth in the upcoming Budget.

Karen Betts, Chief Executive, The Food and Drink Federation (FDF), said:

“This report captures the mood of our sector and as we enter Christmas trading. The combination of tax rises in the last budget, increasing costs like EPR, and policy uncertainty makes for a tough business environment. What’s more, food companies can readily see how impacted shoppers are by continued food price inflation and how careful households are being about spending in the run up to Christmas.

“We fully support the government’s stated ambition for economic growth, and as the UK’s largest manufacturing sector and pillar of the ‘everyday economy’, we want to partner with government to make this happen. There are huge productivity gains to be made in our sector, alongside work to be done to improve environmental sustainability and healthy options. But we need a simpler, stable regulatory pathway if this is to happen, and one that operates across government. And real reform of the unnecessary and out of date regulations that tie companies down and cause opportunity costs.”

Untapped growth opportunities to be seized

The UK’s food and drink manufacturing sector contributes £37bn to the economy, provides half a million jobs in every corner of the country, and underpins the nation’s food security4. Plus, there’s a £14bn growth opportunity which could be unlocked through investment in technology, innovation and the transition to higher skilled jobs5.

FDF is calling for Government to partner with industry to unlock the growth potential of the sector. This could include ensuring that food and drink businesses can access support for new technologies and innovation, like the Made Smarter Innovation funding, or broadening R&D tax credits to include the development of healthier food and drink. It could also include expanding the Growth and Skills Levy to apply to short courses in AI, digital skills and engineering, and creating a new UK trade information portal to help businesses find new customers abroad.

-Ends-

Read the State of Industry report here.

Notes to Editors

- FDF Q3 2025 State of Industry Report

- Business Confidence figures since the 2024 Budget: -47% (Q4 2024); -43% (Q1 2025), -40% (Q2 2025), -60% (Q3 2025)

- Question: How has the change to employer National Insurance Contributions impacted your business?

- FDF, Powering communities across the UK

- FDF and Newton, Future Factory report