Extended Producer Responsibility - an overview

Food and drink manufacturers fully support the need to reduce the negative environmental impact of packaging and to protect the planet. We have long called for reform of the packaging producer responsibility system to drive improved circular outcomes for packaging, increase transparency and better targeting of funds towards improving recycling infrastructure.

We want to constructively engage with the UK and devolved nations governments to build an efficient and effective world class system that delivers good recycling outcomes for the long term whilst minimising cost to business and to consumers.

The objectives behind packaging Extended Producer Responsibility (pEPR) are to drive further circularity of packaging by reducing unnecessary and difficult to recycle packaging and increasing recycling. It aims to do this by making producers pay the full net disposal costs for the packaging they place on the market.

The learnings from international best practice suggest that adopting a producer leadership model for pEPR represents the most efficient and cost-effective way of achieving these objectives. pEPR is a complex project to be delivered at scale and will place substantial new costs on the UK’s food producers, much of which will get passed on to consumers.

There are also many interlinkages and interdependencies between pEPR and the other parts of the Government’s Collection and Packaging Reforms, namely DRS and consistent collections. A whole systems approach is therefore needed involving correct sequencing, and cross-and inter government working and agreement if we are to achieve the whole system transformation that is needed.

The industry needs assurance that the new system will be as cost efficient and transparent as possible and that it can drive whole system change – from how companies use packaging through to how consumers engage with new recycling systems, as well as how councils manage waste collections and help to drive up recycling rates.

In January 2025, PackUK was formally appointed by Defra as the scheme administrator. It is responsible for managing producer registration, collecting packaging data, and overseeing compliance. Additionally, PackUK will set fee rates for specific packaging materials, determining how much producers must pay to place packaging on the UK market.

In May 2025 and consistent with provisions to be introduced via draft amending EPR regulations, the government invited expressions of interest (EOIs) to identify those wishing to form a Producer Responsibility Organisation (PRO). A PRO is a producer-led, not-for-profit body that will assume several functions related to managing pEPR. It will operate according to environmental outcomes set by the government, while retaining autonomy over how these outcomes are achieved. This is the successful norm for effective pEPR schemes globally & FDF firmly believes this model is central to the scheme’s successful delivery, including the effective optimisation of costs.

In conjunction with INCPEN & BRC, FDF has submitted an EOI to establish a PRO that is endorsed by 60 organisations, representing 95 brands, providing experience from working with PROs in 26 other countries. A formal application process will be launched in October 2025 with the PRO expected to be formally appointed by PackUK in March 2026.

The UK and the devolved nations governments have shown some flexibility by removing proposals to include business waste payments in the overall pEPR policy framework. In England and Northern Ireland the respective Governments’ have decided not to extend EPR payments to cover binned and ground litter until there has been time to assess the impact of a future DRS scheme. The Scottish and Welsh Governments remain committed that pEPR should cover the full net costs of both binned and ground litter cleanup and disposal and will bring forward proposals in due course.

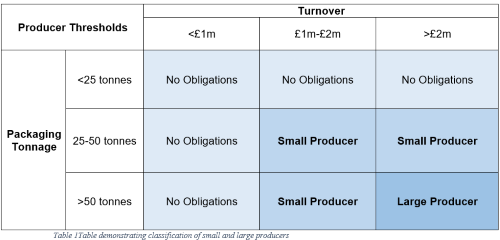

You must take action to comply if the following apply:

- you’re an individual business, subsidiary or group with a registered UK presence

- you have an annual UK turnover of £1 million or more and you handle over 25 tonnes of obligated packaging in a calendar year

- you carry out any of the following activities:

- packaging own-brand products to supply to UK consumers

- using a third party to package and supply own-brand goods to UK consumers

- using unbranded secondary/tertiary to protect goods during transport so they can be supplied to UK consumers

- supplying empty packaging (branded or unbranded) to a business that does not meet the Large Organisation threshold (see definition below)

- importing goods from a brand that does not have a UK presence

- removing packaging from imported goods

- hiring or loaning out reusable packaging to UK third parties

- the owner of an online marketplace facilitating the sale of packaged goods from outside the UK

Small Producer

If you are an organisation with either of the below:

- An annual turnover is £1 million or more and handle 25-50 tonnes of packaging within the UK

- An annual turnover is £1-2 million and handle over 50 tonnes of packaging within the UK

You are obligated to report your packaging data annually but will not be financially obligated to contribute recycling or disposal costs. Specifically you must:

- Pay a registration fee to the environmental regulator from 2025

- An approved person (director or company secretary listed on Companies House) must verify your account

- Submit Jan-Dec 2025 packaging data by 1 April 2026

- Take steps to record data about all the empty packaging and packaged goods you handle and supply through the UK market.

Large Producer

If your organisation has an annual turnover of £2 million or more and handles more than 50 tonnes of packaging in the UK you must:

- Register your business through the RPD portal

- An approved person (director or company secretary listed on Companies House) must verify your account

- Buy PRNs or PERNs to meet your recycling obligations. A compliance scheme can do this on your behalf

- Submit data (in kilograms) about empty packaging or packaged goods you handled or supplied through the UK market

- Pay a registration fee to the environmental regulator from 2025

- Pay disposal fees for household packaging, with the first invoice being issued in early October 2025

For packaging placed on the market during the period 1 January to 30 June 2025, submit data by 1 October 2025.

For packaging placed on the market during the period 1 July to 31 December 2025, submit data by 1 April 2026.

Large producers will be required to pay the invoice within 50 days of being issues or, alternatively, may opt to pay in quarterly instalments as follows:

- November 2025 – 25%

- January 2026 – 25%

- April 2026 – 25%

- June 2026 – 25%

Household and Non-Household packaging

Only household packaging will incur disposal fees under pEPR, so it is important to correctly differentiate between household and non-household packaging when reporting data.

Secondary and Tertiary packaging must be classed as non-household.

Primary and Shipment packaging must be classed as household unless:

- you supply it directly to a business/public institution which is the end user of the goods or which supplies goods to an end user with all packaging removed, or

- you supply it indirectly to a business/public institution (eg via wholesaler) and the packaging is for a product only designed for business/public institution used and is not reasonably likely to be disposed of in a household or public bin, or

- you are an importer and import packaging into the UK which is discarded without being supplied to anyone.

You need to be able to show evidence if classing primary or shipment packaging as non-household, and you must keep this evidence for at least 7 years.

The Government is aware of ongoing concerns that the exemptions from the definition of household packaging are not working as intended, particularly where distribution is via third parties. These concerns include the implications for producer fees given the perceived disconnect between where waste is disposed of and regulatory definitions. We are currently working with Defra, the Regulators and other industry bodies to find the right solution for this issue. We will provide further guidance and updates for members as this work progresses.

For any organisation that must act under EPR, you must also submit Nation data if you do any of the following:

- supply packaging directly to customers in the UK, where they are the end user of the packaging

- supply empty packaging to UK organisations that are either not legally obligated, or are classed as a small producer

- hire or loan out reusable packaging

- own an online marketplace where organisations that are based outside the UK

- sell their empty packaging and packaged goods to UK consumers

- import packaged goods into the UK for your own use and discard the packaging

Organisations that have an annual turnover below £1 million and handle less than 25 tonnes of packaging in a calendar year are non-obligated, and do not need to report any data under EPR.

Nation of sale data will need to be reported by:

- 1 October 2025 for packaging placed on the market from 1 January 2025 to 30 June 2025; and by

- 1 April 2025 for packaging placed on the market between 1 July 2025 and 31 December 2025 period

NB Small producers can report annually in line with their EPR data reporting requirements

This data needs to show where in the UK (by Nation) you have supplied packaging to an end-user. Although it remains a requirement to report this data, the EA and other nation regulators have issued a Regulatory Position delaying the enforcement of reporting nation of sale data until 2026

Mandatory Binary Labelling

In the process of finalising the pEPR Regulations in 2024 a decision was taken to remove the provisions that relate to the introduction of mandatory labelling pending a review of the provisions developed under the EU packaging and packaging waste regulation (PPWR) and the scope for alignment in order to reduce complexity for producers selling into both markets.

Collecting and submitting your packaging data

When collecting data for your submission you must consider:

- individual materials in the packaging you handle and supply

- whether a piece of packaging is 'primary', 'secondary' 'transit', or ‘shipment’

- whether the packaging is likely to become household or non-household waste (please see DEFRA’s definitions of packaging types, and how to evidence packaging as non-household)

- whether the packaging is likely to end up in street bins

- what material type(s) are used in the packaging you handle, including:

- Paper/Cardboard

- Glass

- Aluminium

- Steel

- Plastic

- Wood

- Fibre-based composites (a new category for pEPR)

- 'Other' (any material not included in the above, eg. ceramic, hessian. This includes biodegradable/compostable plastics. Each material type must be listed separately)

All weights must be reported in kilograms.

From January 2025, large producers must report plastic household and public binned packaging as either rigid or flexible. This applies to January–June 2025 data due by 1 October 2025 and is separate from RAM reporting. This applies even if RAM data is not submitted (see below).

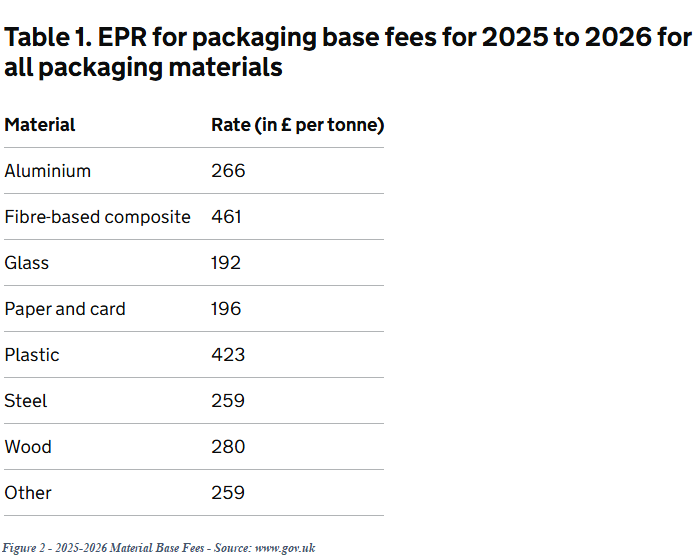

Currently, producers are only required to pay fees based on the amount and material type(s) of packaging placed on the UK market. These are known as base fees and will apply to invoices issued in 2025. PackUK has now published the final EPR base fees which will be used for year 1 (2025 to 2026) of the scheme.

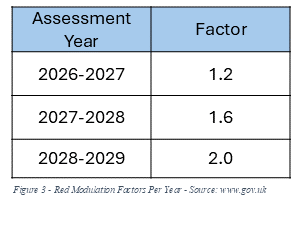

From 2026, these fees will be modulated based on the recyclability of the packaging. Packaging that is harder to recycle will attract higher modulated fees, while packaging that is easier to recycle will be subject to lower fees relative to the material base fee thus encouraging more recyclable packaging design. The recyclability of packaging components is assessed using the Recyclability Assessment Methodology (RAM).

The RAM provides technical guidance for assessing recyclability leading to a traffic light grading system: green indicates easy-to-recycle materials, orange indicates materials which present barriers to being recycled while red denotes those that are difficult to recycle. RAM is reviewed annually by a Technical Advisory Committee (TAC) made up of stakeholders from across the value chain, and updated versions are published ahead of each reporting cycle.

To encourage the use of more recyclable material, if packaging classified as red by the RAM is placed on the market, the packaging waste disposal fees will equal the material base fees multiplied by the modulation factor for that year. However, if a material is classified as green by the RAM, each tonne of packaging place on the market will receive an equal percentage discount on its household packaging waste disposal fee. Amber-rated material will see no change in its household packaging waste disposal fee because of modulation.

In June 2025, the EA issued RPS 350, giving temporary relief on pEPR recyclability assessment deadlines for the October 2025 reporting deadline. Producers must still assess the recyclability of household packaging supplied between 1 January and 30 June 2025, keep records, and report to the Agency. However, enforcement will not normally occur if these assessments are completed and reported together with those for 1 July to 31 December 2025 by the deadline of 1 April 2026. This only applies to the 1 October 2025 reporting deadline not subsequent reporting deadlines.

How much will it cost manufacturers?

The financial implications of Extended Producer Responsibility (EPR) for manufacturers will be substantial, with costs determined primarily by the recyclability of the packaging they place on the market. From 2026 onwards, disposal fees will rise incrementally, and producers that continue to use packaging assessed as less recyclable could face costs up to twice the base fee by 2028–29. Conversely, manufacturers that utilise more recyclable packaging formats will benefit from lower charges, as revenue from higher fees levied on less recyclable materials will be redistributed. The overall cost burden for individual producers will therefore depend on the composition of their packaging portfolio and the extent to which they transition to more recyclable materials as defined within the RAM.

-

- Statutory Instrument and Agreed Positions

The Producer Responsibility Obligations (Packaging and Packaging Waste) Regulations 2024

The Producer Responsibility Obligations (Packaging and Packaging Waste) (Amendment) Regulations 2025

Agreed Positions and Technical Interpretations, Version 6 (EA, SEPA, NIEA)

Extended Producer Responsibility for Packaging (pEPR) producer data requirements: RPS 330

Extended Producer Responsibility for packaging: who is affected and what to do

Packaging data: what to collect for extended producer responsibility

Packaging data: how to create your file for extended producer responsibility

- PackUK: EPR Scheme Administrator Webpage

-

Demonstration of how to use the tool

Resources and Waste Forums - hosted by DEFRA and held monthly, for all stakeholders to be kept informed about the reforms programme that includes Extended Producer Responsibility (EPR), Deposit Return Scheme (DRS), and Consistency of Collections.

Receive the most up-to-date information on the Collections and Packaging reforms: Sign up to DEFRA's Circular Economy Newsletter.