Food and drink sector recovers in January

11 March 2022

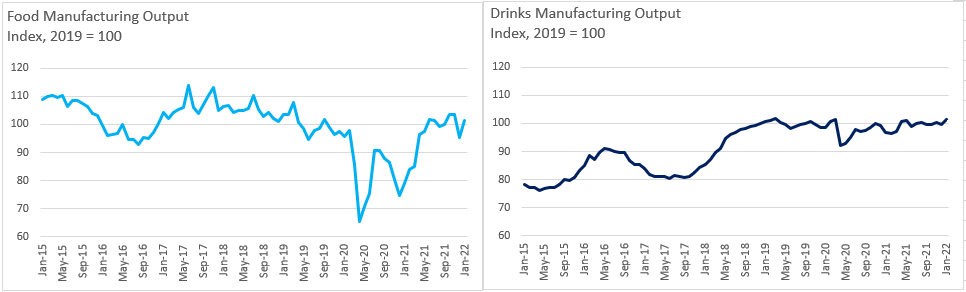

The food and drink manufacturing sector recovered strongly in January, with food production 6.4% higher than in December and drinks manufacturing output increasing by 1.8%.

Topics

- Business insights & economics

- Inflation

The UK economy bounced back swiftly from the blow of the Omicron variant, with January’s GDP rising by 0.8% on the month, after shrinking by 0.2% in December. All sectors showed growth in January. Improvement in the service sector was driven by hospitality, as people were more confident to eat out.

Food and drink manufacturing output

Source: ONS

Alas, the outlook for growth is darkening. The war in Ukraine is bringing significant economic pain for the world, with sanctions and regulations changing rapidly and businesses trying to adapt. Current economic conditions are very fluid, characterised by heightened market volatility and extraordinary uncertainty. It’s too early to put a number on global economic losses from the conflict but there’s no doubt the war will deliver a severe economic blow, fuelling inflation and further disrupting supply chains and logistics. In turn, this will negatively impact production and eat into households’ budgets.

The food and drink industry is not insulated from the shock. Gas and oil price rises mean production costs will increase yet again. These fresh rises come at a time when a year of increasing cost pressures have pushed profit margins in the sector to razor-thin levels. Prices of oil and gas shot up to historical records this week as the world is scrambling to decouple itself from Russia. There are no short-term solutions when it comes to gas and only a partial replacement of Russian oil output is possible, provided OPEC agree to it. This means food and drink businesses will be hit with substantial higher operating costs.

Moreover, the industry depends on Ukraine and Russia for key ingredients. Ukraine is the UK’s single biggest source of imported sunflower oil, rapeseed oil and maize. Ukraine and Russia are by a distance the two largest producers and exporters of sunflower oil, accounting for nearly 60% of global production and 75% of exports. And there are indirect impacts too. For instance, wheat prices in the UK will certainly increase, even if only 3% of imported wheat comes from Ukraine and Russia. But Ukraine and Russia account for nearly 30% of global exports, less wheat available for the world will push prices of wheat up everywhere.

In short, the prospect for 2022, both for the industry and the wider economy, is inflation and slowing growth, exacerbated by the war in Ukraine. The government is tight for choices. The Bank of England now is faced with the choice of continuing to raise interest rates to tame inflation, but sacrificing growth, or letting inflation run unchecked to protect growth. The Government could choose to provide some more help to households and the FDF will work with them to provide solutions to support businesses and alleviate the pain from high energy costs.