One year of easing food inflation

17 April 2024

Annual food and non-alcoholic drink inflation had continued to ease in March to 4.0%, down from 5.0% in February. This is the lowest rate since November 2021, and this month marks one year of slowing inflation. On the month, prices rose again by 0.2%.

Topics

- Inflation

- Business insights & economics

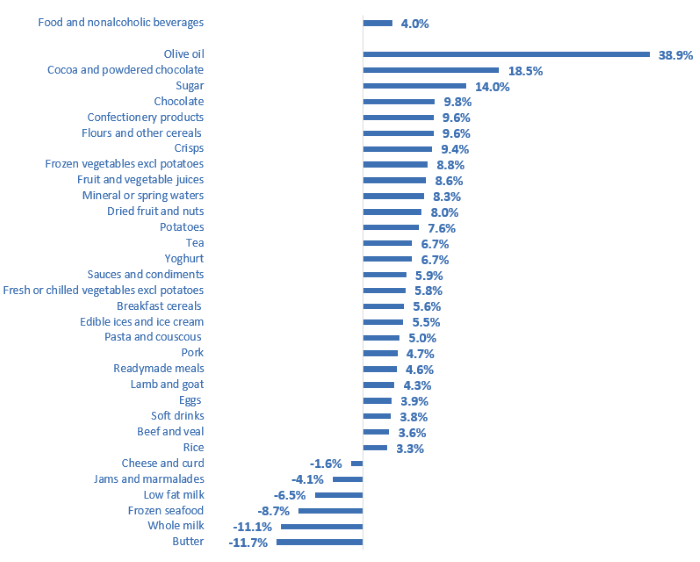

In March, eight out of the 49 categories reported by the Office for National Statistics (ONS) were in deflationary territory, with prices of butter, whole milk and frozen seafood falling at the fastest annual pace of 11.7%, 11.1% and 8.7%, respectively (see chart). 19 categories saw price rises of 5% or less. While only three categories saw double-digit price rises: olive oil, ‘cocoa and powdered chocolate drinks’ and sugar by 38.9%, 18.5% and 14.0%, respectively.

Food and non-alcoholic drink year-on-year inflation by category

Source: ONS

The ONS data also shows that overall costs to manufacturing have been declining for the past five months. In March, costs fell at the fastest annual pace yet of 1.9%, compared to a decline of 1.0% (revised) in February. Imported ingredients annual costs fell by 1.7%, the first decrease since April 2021, while UK-sourced ingredients prices were 2.5% lower than a year ago, the steepest decline of the past seven months.

Changes to input costs can take between seven and twelve months to filter through to final consumer prices, which means that current developments will continue to put downward pressures on consumer prices later in the year. Nonetheless, factors at play might undo some of these gains. Stubborn labour shortages, the cost-of-living crisis and the recent rise in the National Living Wage have meant that overall wages have increased and are likely to continue to do so over the coming months. The new border checks for imports (from the EU) coming into effect at the end of the April will also add to ongoing operating costs.

SMEs are likely to be disproportionately impacted by both the increases in minimum pay rates and the border checks as the government changed its border approach from one charge per declaration, even if multiple good included, to businesses being charged per item (capped at five). This will significantly increase costs for companies bringing in mixed product loads.

Further risks to future prices include extreme weather patterns that are impacting agriculture globally. This has been visible in the UK in recent weeks with this winter’s wet weather causing widespread flooding on farmland. Price rises of beef, lamb and dairy products are most at risk, as animal feed is likely to get more expensive. At the same time, global food prices saw their first uptick on the month in March, following a 7-month decline, although they were 7.7% lower on the year. The rise was due to increases in the prices of vegetable oils, dairy products and meat which offset decreases in those of sugar and cereals.

While supply chain disruptions from global shipping are impacting many UK manufacturers.

In the context of the shocks in the recent years, demand recovery remains key for the industry’s revitalisation and will enable manufacturers to restore investment. According to ONS data, business investment in the industry was 30.5% lower in 2023 compared to 2019.

In the wider economy, inflation continued to slow, albeit not as fast as analysts predicted. March’s headline CPI came in at 3.2%, down from 3.4% the previous month, but above expectations of 3.1%. Core inflation, a better measure of underlying inflation as it excludes more volatile items such as food and energy, slowed to 4.2%, down from 4.5% in February. While service inflation, another indicator thought to be a better measure of domestic price pressures, inched down to 6.0% from 6.1% in February.

UK wage growth has softened, although remains high by historical standards and uncomfortably high for the Bank of England’s expectations. Annual regular pay increased by 6.0% over the three months to February and total pay by 5.6%. But there are signs that the labour market is cooling, with labour shortages easing steadily, and unemployment and inactivity rising.

This means that it’s likely that the Bank of England will cut rates this year, with financial markets expecting now two rate cuts, the first one in August or September.

FDF welcomes the Prime Minister’s intention to hold another farm to fork summit at No 10 next month. Food security should be a focus of this, and how all parts of the food system work together – and with government – to ensure the UK has a secure supply of good quality and affordable food and drink. A central part of this is regulation, and ensuring this fosters investment in the UK, including in innovation and food science. Unfortunately, current government plans for ‘not for EU’ labelling will have the opposite effect, as will current government plans for Forest Risk Commodity regulations, where industry want the same outcome as government but current proposals are not well designed and will create unnecessary burdens for supply chains. Both could lead to a disinvestment in UK food and drink over time. We hope the summit will help to resolve problems such as these with forward-looking solutions that are well within our reach.