Food inflation soars to yet new levels

October is the fifteenth month of accelerating annual food and drink inflation, with prices rising by 16.4% compared to a year ago, above September’s 14.6%. This is estimated to be the highest inflation rate since September 1977. Month-on-month, prices have risen by 2.0%.

Topics

Higher energy and food prices pushed up UK inflation to 11.1% in October, up from 10.1% in September.

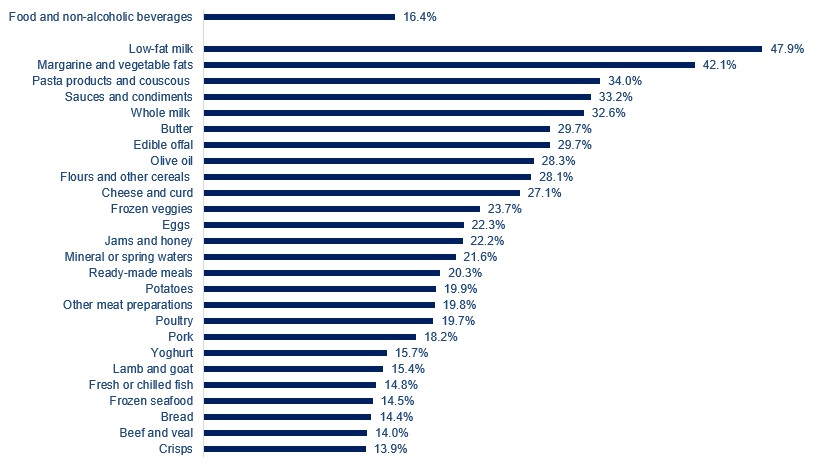

Of the 49 main food categories reported in the official statistics, 41 recorded double-digit inflation. Naturally, as food inflation is accelerating, more categories are seeing higher rises, with low-fat milk inflation approaching 50%, at 47.9%. Inflation climbed for pasta (34.0%), butter (29.7%), eggs (22.3%), or pork meat (18.2%). The category ‘other tubers’ saw the slowest increase in prices at 3.8%.

Food and drink inflation by category

Pressures on food and drink manufacturers continue to mount as rises in ingredient costs have reached fresh highs in October. Food ingredients produced in the UK were 18.8% more expensive in October (up from 17.8%, revised, in September) and imported ingredients 31.0% costlier (up from 29.3%, revised, in September). Goods leaving the manufacturers’ facilities saw inflation inching up to 16.1% (up from 15.8%, revised, in September).

Energy is the main driver for these changes, besides the pound depreciation which pushes up the cost of foreign goods. Costlier energy costs – gas prices are now about five-fold higher on the year in the UK and Europe alike, mean that energy will impact final food prices both directly, through the impact it has on manufacturers, and indirectly, through the impact it has on the suppliers to manufacturers. On average, our members reported that energy costs as a share of operating costs accounted for 22%, up from 12% in Q3 2021.

Labour shortages are another significant headache for our manufacturers. In sharp contrast with the UK economy, where vacancies have been easing for the past four months, manufacturers have reported more acute labour shortages in Q3 compared to Q2. Manufacturers reported 9.1 vacancies per 100 employees in Q3, up from 6.3 in Q2, and well-above UK’s level of 4.1.

Global food prices have receded from their March peak in recent months, although they were 43% higher in October compared to October 2019, with vegetable oils 79% costlier. Many uncertainties about future global production of grain, maize and vegetable oil persist, including whether the Black Sea Grain Initiative will be extended beyond November 19th, when and how other countries will be able to replace lost Ukrainian and Russian exports and how severe weather shocks will be in the future.

Moreover, many agricultural commodities are traded in dollars, meaning that UK producers will not be able to enjoy the benefits of these price declines. Imported ingredients and raw materials are critical to UK food and drink. For manufacturers, they provide goods that are not (sufficiently) produced at home and help manage the risk of uncertainty of seasonal production and capricious climate. While for consumers, imports enable a much wider selection of items than what could be available using solely UK-grown or -produced foodstuff.

The next few months will shape the industry’s future, as the survival of many SMEs might be at stake. Over two years now of unyielding rises in every cost component and labour shortages have worn industry’s resilience thin. These challenging conditions continue against a backdrop of financial conditions tightening rapidly -- the Bank of England rose interest rates to 3.0% earlier this month, and more rises are expected, a historical drop in household’s real income and a recessionary economic outlook.

The number of insolvencies in the food and drink manufacturing over the first nine months of the year has surpassed the number of insolvencies in the entire 2019. The Q3 FDF State of Industry survey found that current cost pressures were likely to limit capital investment over the next year for 70% of our respondents, while half have already paused or cancelled investment projects. This will, undoubtedly, impact both the growth of our industry and its competitiveness.

Government could help ease these pressures by reducing the costs of doing business, for example through simplifying regulation, reducing the cost of trade with the EU, and helping companies to invest in growth, innovation and skills through tax incentives. To that end, we’re looking forward to seeing what measures the Chancellor will set out in his Autumn Statement tomorrow.