A new high for food inflation

The food and drink annual inflation rate jumped to 18.2% in February from 16.8% in January, outpacing the UK’s Consumer Prices Index (CPI) inflation of 10.4%, which also saw an acceleration from 10.1% the previous month. This is the highest rate of food inflation in 45 years since August 1977. On the month, prices rose by 2.1%.

Topics

The largest upward effect came from vegetables which were in short supply, impacted by both bad weather in Spain and Africa and lower greenhouse production in the UK and the Netherlands due to higher electricity prices. This pushed vegetables inflation to 18.0%, the highest rate since February 2009.

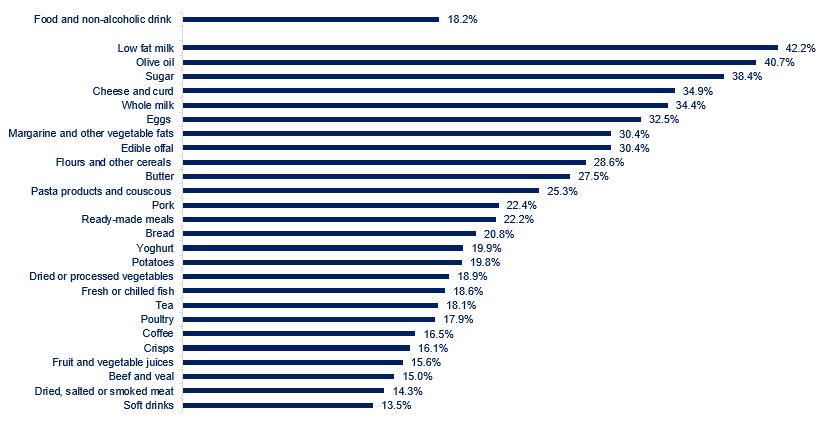

Of the 49 main food categories reported in the official statistics, 43 recorded double-digit inflation. Low fat milk saw the highest rise in prices on the year, at 42.2%, while ‘other tubers’ saw the slowest increase in prices at 2.4%.

Food and drink inflation by category

Source: ONS

Food and drink manufacturers faced higher prices for their ingredients, with UK-sourced ingredients 15.1% more expensive in February (down from 16.9% in January) and imported ingredients 30.5% costlier (up from 27.4% in January). Goods leaving the manufacturers’ facilities—output gate prices, saw inflation at 16.6% (unchanged from January).

Despite this month’s jump, we believe we are nearing the peak, and expect food inflation to start slowing in Q2. But slowing food inflation means that food prices rise at a slower pace, and not that prices will start falling. Prices will continue to rise as it takes seven to twelve months for producer costs to filter through to consumer prices. We expect food inflation to remain in double-digits throughout 2023.

Manufacturers have sustained substantial cost increases in all aspects of their businesses in 2021 and 2022. Despite being a typically low-profit margin industry, food and drink manufacturers have absorbed a significant proportion of these cost increases. Manufacturers stated that production costs went up on average 21% in 2022, while their selling prices increased on average by only 9%, with 20% of the smaller businesses not being able to raise their selling prices at all.

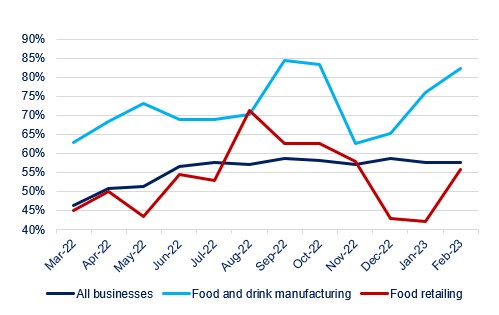

ONS figures corroborate this data showing that over the year to February, on average, 72% of food and drink manufacturers stated they had to absorb rising costs. That compares with 56% of all companies across the UK and 53% of food retailers, suggesting that our industry has been disproportionately impacted by the rise in input costs during the pandemic and the war in Ukraine, compared to the average UK business. It also suggests food and drink manufacturers have continued to buffer households from the full extent of rising costs.

Percentage of businesses that had to absorb costs to deal with cost rises

Source: ONS

In the longer term, the continuous improvement in some conditions is good news, although uncertainty persists. Global food prices have persistently fallen since March 2022, but remain at historic highs, with February prices 31% above their February 2020 levels. There are significant concerns in the market about crop yields this year, as the impact of lower fertiliser use in last autumn’s and this spring’s plantings cannot yet be estimated. That is against a backdrop of lower global food stocks, increased adverse weather impacts, lower plantings in Ukraine and the recent Black Sea Initiative extension by only two months.

Pressures in global logistics built up during the pandemic are now starting to return to ‘normal’, although many in our industry continue to face significant supply chain issues, especially around fresh produce and manufacturing equipment. Oil prices are now about 30% cheaper than in June 2022. Wholesale gas prices have also been declining, but remain about double their 2019 prices.

While uncertainty around future demand continues, as the cost of living crisis is ongoing and food volumes have fallen. BRC-KPMG food sales growth of 8.3% ran below inflation of 17.3% over the three months to February, implying a loss in volumes of about 9%. And although the labour market remains tight, slower wage growth, a drop in vacancies and economic inactivity point to a cooling market. Coupled with slowing economic activity, this means that pressures on households remain strong.

All of this points to another challenging year ahead for manufacturers, costs remain at record highs, albeit pressures are subsiding, ongoing staff shortages, lower demand and high uncertainty.

For the wider economy, the unexpected pick-up in the CPI headline inflation figure – analysts were expecting a drop to 9.9% and, more importantly, also the pick-up in core inflation to 6.2% from 5.8% in January, complicate the Bank of England’s interest rate decision tomorrow. Slowing wage growth and the deterioration in global financial conditions as a result of the American and Swiss bank troubles make the case for a pause in rate hikes, while inflation acceleration counterbalances that view.

The industry welcomed Jeremy Hunt’s pledge to halve inflation this year made in last week’s budget. There’s certainly more the government can do to help our sector achieve this. The agreement of the Windsor Framework is a strong step forward, and implementing these new rules in a pragmatic way will be important. But the lack of ambition in the government’s plans to further regulate the recycling of plastics and packaging in the UK is worrying – if they are not adjusted in line with international best practice, they will stifle much-needed investment and risk failing consumers, businesses and the environment while pushing up costs.

See our Prices Dashboard to access the latest data on the prices of food and drink, agricultural commodities, energy, transportation and packaging.