Food inflation picks up more speed

Food and drink annual inflation accelerated in March to 19.2% from 18.2% in February, above CPI’s inflation of 10.1%. This is the highest rate in 45 years since August 1977. On the month, prices rose by 1.1%.

Topics

The largest upward effect came from bread and cereals, with prices rising by 19.4%, the highest annual rate on record. Other smaller upward effects came from fruit, chocolate and confectionery, and meat, partly offset by a downward movement from oils and fats, where the annual rate slowed from 32.1% to 25.6%.

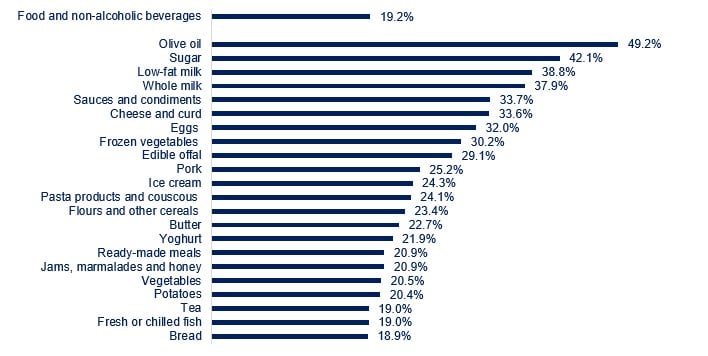

Of the 49 main food categories reported in the official statistics, 45 recorded double-digit inflation, with olive oil seeing the highest rise in prices on the year, at 49.2%, and ‘Other tubers’ the lowest, at 2.0%.

Food and drink inflation by category

Source: ONS

Producer price developments suggest that input costs are approaching peak inflation. Specifically, inflation faced by manufacturers for UK-sourced ingredients slowed to 15.1% (down from 15.2% in February) and for imported ingredients to 29.1% (down from 30.6% in February). Goods leaving manufacturers’ facilities – output gate prices, saw inflation ease, falling to 15.5% (down from 16.1% in February).

With producer prices a lead indicator for consumer prices, this means food and drink inflation is likely nearing its peak as well. Indeed, we think food and drink inflation will begin to slow in the next couple of months, although our modelling suggests it will remain in double-digit territory throughout 2023. That is due to the lag with which cost changes feed through to final consumer prices, but also because not all pressures have started to ease. While global food prices were 20.5% lower year-on-year in March, gas prices have halved on the year and logistics performance has improved, severe labour shortages continue to afflict the industry.

The UK’s red hot labour market appears to be cooling, so there’s some hope that labour pressures may start to ease for the industry as well. Most recent data shows that in addition to an ongoing reduction in vacancies, which fell to their lowest in 19 months in March to 1.1mil, weaker hiring intentions and an easing in recruitment difficulties are also now being reported. While private sector pay growth has slowed to 6.9%, the lowest since September 2022.

Manufacturers continue to find themselves in a challenging position. Having sustained almost three years of unrelenting pressures across all aspects of their businesses, from ingredients and energy, to packaging, labour, and transportation, resilience and the ability to cope with further price shocks has been substantially eroded.

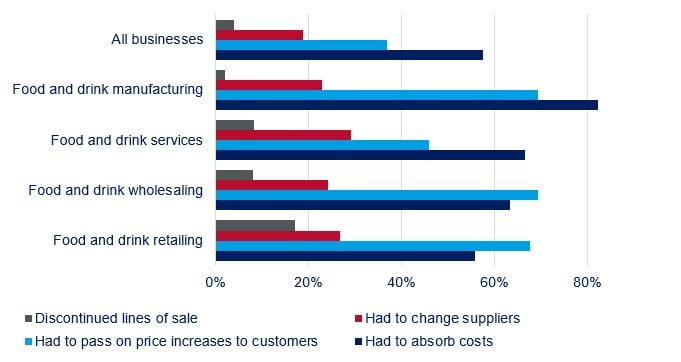

To limit the scale of consumer price increases, the industry tackled cost pressures in a variety of ways, notably by changing procurement strategies, becoming more energy efficient and pausing or cancelling investment projects. However, the extent and scope of cost rises meant that a large share had to be absorbed. Over the year to February, on average, 72% of food and drink manufacturers absorbed a share of rising costs, compared with 56% of all UK businesses. More recently (see chart below), that figure rose to 82%, a substantially higher proportion than retailers and wholesalers, suggesting that while our industry has been disproportionately impacted by rising input costs, it has also taken the biggest hit in order to shield households from the full impacts of rising costs.

Percentage of businesses reporting how they are affected by price rises

Source: ONS, Business Insights and Conditions Survey, 6 to 19 February 2023

ONS data shows investment in the food and drink industry has been on a downward trajectory since Q3 2021, corroborating our findings that intense cost pressures negatively impacted investment in the sector. Moreover, the persistent fall in real consumer spend poses an additional hurdle. BRC – KPMG sales show that total food sales increased 8.5% in the three months to March 2023. With food inflation at 18.0% in Q1 2023, this points to a fall in sales volumes of close to 10%. Coupled with eroded margins, all of this points to significant risks to growth in the industry.

In the wider economy, there are signs that growth might beat market forecasts over the first three months of the year. UK output has finally risen above pre-pandemic levels, despite not changing between January and February, following a revised 0.4% expansion in the previous month. This means that the UK is likely to avoid a recession. It also means higher chances for the Bank of England increasing rates yet again at their May meeting to put downward pressure on demand.

The Government needs to work with us if they want to achieve their goal of halving inflation by the end of this year, by helping us to address persistent labour shortages, support companies to invest in training to upskill and reskill their workforce to ensure incoming regulation- such as new recycling reforms for packaging, don’t put an additional burden on prices for businesses and consumers.