Food prices drop for the first time in two years

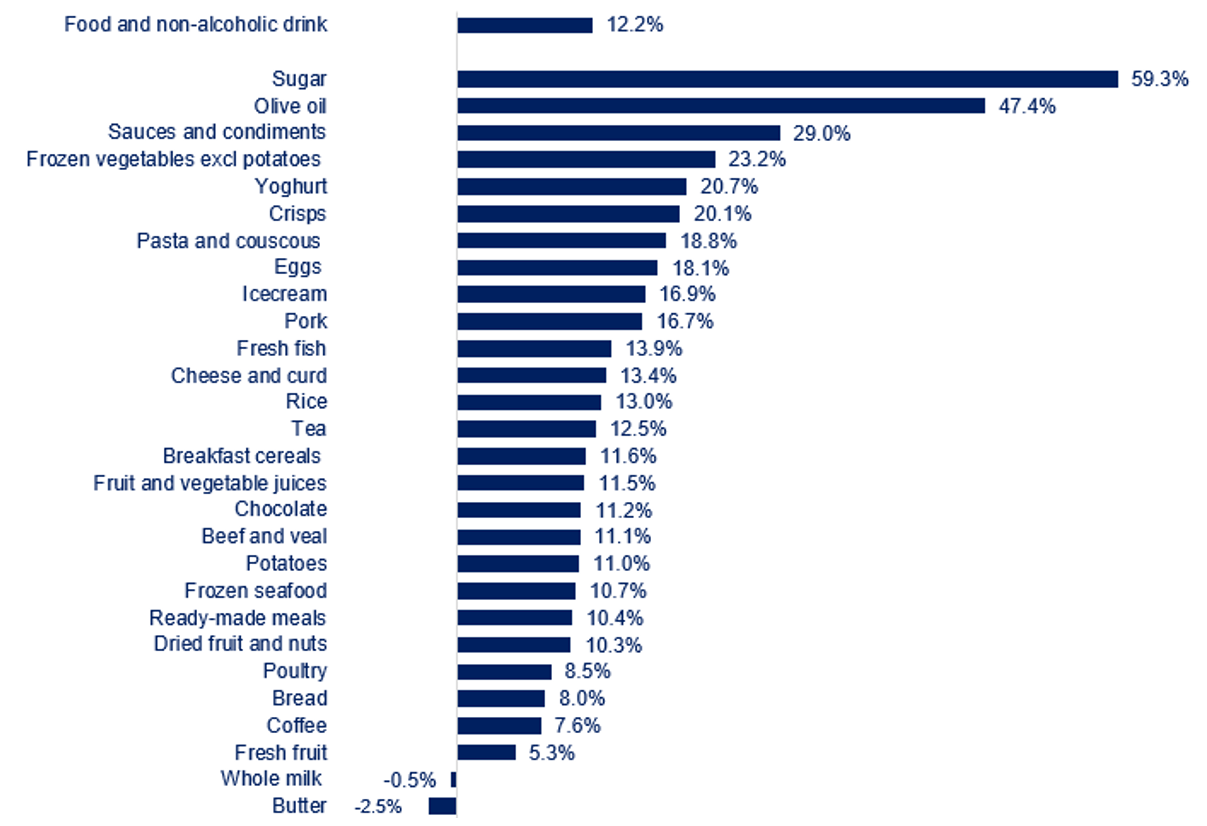

September brought some good news for consumers, with food and non-alcoholic drink prices falling for the first time in two years, albeit a modest drop of 0.1%. Compared to a year ago, food prices were 12.2% higher. While annual inflation remains in double-digits, this is a move in the right direction, with inflation easing for the six consecutive month, and down from 13.6% in August.

Topics

By category, year on year inflation has been slowing for most food items. The notable exceptions are sugar (for which inflation accelerated to 59.3% up from 55.8% in August) and olive oil (inflation climbed to 47.4%, up from 38.3%). Butter and whole milk have crossed into deflationary territory (see chart).

Food and non-alcoholic drink annual inflation by category

Source: ONS

Compared to last month, prices fell for 22 out of the 49 main categories reported by the Office for National Statistics (ONS), with pasta prices 4.8% lower in September than in August, yoghurt 3.5% lower or pork 1.1% lower.

On the producer side, ONS data shows cost pressures on manufacturers are subsiding, with year on year cost inflation slowing, and some costs falling on the month. Overall costs facing food and drink manufacturers rose on an annual basis by 0.6% in September, down from 2.7% in August, while on the month these costs fell by 0.2%, the sixth month in a row of cost declines. By category of costs, UK-sourced ingredients were 1.9% lower than a year ago and 0.4% lower than in August, while imported ingredient prices were 10.3% more expensive on the year and 0.6% on the month. Annual inflation of goods leaving manufacturers’ facilities – output gate prices, slowed to 3.7%, while on the month prices fell by 0.5%.

It takes seven to twelve months for changes in production costs to pass through the supply chain to retail prices. September data confirms that declines in global commodity prices, energy and logistics have been filtering through and we are starting to see those impacts in retail prices.

Nevertheless, it would be too early to declare this inflationary episode done, as weather impacts, international geopolitics and domestic policies might bring fresh inflationary pressures.

The unusual weather patterns all over the world means lower yields and crops. In particular, there’s a lower output of olive oil and tomatoes and cucumbers in Spain and Italy, onions in Germany, or peppers in Morocco and a worldwide shortage of citrus. Cote d’Ivoire produces 70% of the global cocoa output and it’s seen too much rain and too little sunshine, while erratic weather also threatens coffee output in the three leading producing countries. New Black Sea corridors used by Ukraine for shipping grain are proving significantly more expensive than when the Black Sea Grain Deal was in place, which risks pushing up grain prices again. And with the El Niño continuing, all of this means that some commodities will see ongoing price pressures.

Moreover, oil prices have been rising in the last two months, with the benchmark Brent reaching over $90/barrel, from $70. The risk of escalating conflict in the Middle East might disrupt oil supplies from the region. The strengthening of the US dollar, due to a rise in US yields and strong economy, pushed the sterling to its six-month low, which will make imports more expensive, especially as many commodities are traded in dollars.

And, at the same time, significant labour shortages, across all skill levels, hinder the industry’s growth and keep labour costs elevated. Industry’s vacancy rate (the number of vacancies per 100 employees) eased in Q2 to 4.8% from 5.9% in Q1, although it remains higher than rates in the wider manufacturing and the UK, of 2.9% and 3.3% respectively.

In the wider economy, consumer price inflation (CPI) stood at 6.7% in September, unchanged from August. Food and non-alcoholic drink provided the largest downward contribution to the annual UK-wide inflation rate, although that was offset by higher prices of motor fuel and hotel accommodation.

Core inflation – an inflation measure which excludes more volatile items such as food and energy, which makes it a better measure of underlying inflation, has inched down to 6.1%, from 6.2% in August.

The snail’s pace in inflation easing and persistent wage rises, above inflation in the public sector in June and July (at 8.2% and 8.1%, respectively), keep the Bank of England in a bind. Last month, the Bank decided to keep its rate unchanged at 5.25%, the first time in 15 meetings when the rate had not increased. The markets bet on another pause in rate hikes this month. As the rationale for halting the rate rises was to allow markets to adjust to higher borrowing costs and for those impacts to reflect in prices, it’s reasonable to expect no change again.

Many companies in our sector, particularly SMEs which make up 97% of the industry, are struggling to recruit workers. The government could do more to help by rapidly implementing the recommendations set out in the Independent Review of Labour Shortages in the food supply chain and by reducing unnecessary regulatory burdens, including urgently reviewing new and costly ‘not for EU’ labelling plans for food sold in Great Britain.