Food inflation slows to below 3.0%

Annual food and non-alcoholic drink inflation eased again in April, for the 13th consecutive month, to 2.9%, down from 4.0% in March. This is the lowest food and drink inflation rate since November 2021. However, on the month, prices rose by 0.3%.

Topics

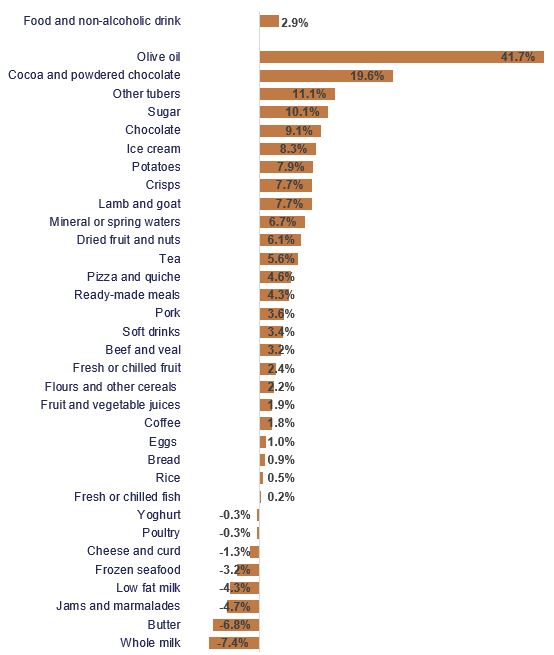

In March, 13 out of the 49 categories reported by the Office for the National Statistics (ONS) were in deflationary territory, with prices of whole milk, butter and ‘jams and marmalades’ falling at the fastest annual pace of 7.4%, 6.8% and 4.7%, respectively (see chart). While only four categories saw price rises in double digits: olive oil, ‘cocoa and powdered chocolate drinks’, other tubers and sugar at 41.7%, 19.6%, 11.1% and 10.1%, respectively.

Food and non-alcoholic drink year-on-year inflation by category

Source: ONS

April was the sixth consecutive month when overall costs to manufacturing were lower on a yearly basis, total costs falling by 0.3%. Prices of imported ingredients also decreased year on year by 1.7%, while UK-sourced ingredients rose by 1.1%, breaking a declining trend of seven months. On the month, overall costs rose by 1.1%, with imported ingredients rising by 0.4% and domestic ingredients by 2.0%.

The annual rate of food and non-alcoholic drink inflation is likely to ease in the coming months, although some upward pressures on costs remain. Stubborn labour shortages continue to impact the industry. The vacancy rate in food and drink manufacturing stood at 5.0% in Q1 compared to 5.2% in Q4, above rates in wider manufacturing and the UK, at 2.7% and 2.9% respectively. Further escalations in the Middle East might lead to surges in oil, energy and shipping costs, with unusual weather impacting agricultural yields and prices. Since February, prices of global agricultural commodities rose by 1.4% and of gas by 18%, although, for now, these are seen as normal market fluctuations.

On the whole, market conditions have stabilised. As a result, manufacturers’ business confidence increased to its highest level in Q1. While conditions have stabilised, manufacturers are yet to recover from what has been a challenging, unprecedented few years, which left the industry in a precarious situation. In 2023, the industry’s investment was 30.5% lower than in 2019, contrasting with the manufacturing sector (excluding food and drink manufacturing) and UK as a whole, where investment rose by 5.4% and 5.0%, respectively.

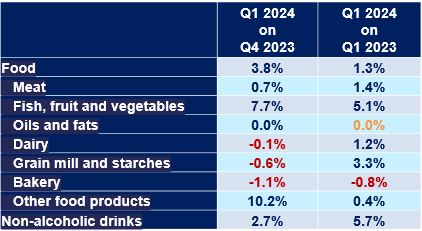

Manufacturers are now seeking to rebuild their margins and cash reserves to be able to invest. To do this, they will need to increase their sales. ONS output data for Q1 shows that industry’s output is on the way up, both compared to last year and to last quarter. This is aligned with our industry survey results as well. Compared to the last quarter, food production was up by 3.8% and non-alcoholic drinks by 2.7% (see table). The rise is not generalised across all sectors, with bakery, grains and dairy seeing some contractions.

Growth by subsector

Source: ONS, GVA, Chained volume measures

On the whole, this is a positive sign of the industry’s recovery. Nonetheless, a robust, sustained recovery might not be achievable in the short term. Households are emerging from the cost of living crisis in a worse financial position than in 2020, in real terms. NIESR estimates that households in the lowest 40% of the income distribution will see lower living standards by 7 to 20% in 2024-25 compared with 2019-20. It’s not surprising then that ONS surveys found that 36% of consumers in Great Britain were spending less on food and essentials at the beginning of May, and 48% were shopping around more. Similarly, KPMG’s Consumer Pulse survey found that 38% of UK consumers bought more own brand or value range items in Q1, 37% bought more promotional or discounted items, while 27% did their shopping at discount grocery retailers.

In the wider economy, inflation continued to slow, albeit not as fast as market analysts predicted. Overall CPI inflation slowed to 2.3% in April, down from 3.2% the previous month, above expectations of 2.1%. The main driver behind this steep fall was the reduction in the regulatory cap on households energy prices, although food and non-alcoholic drink inflation also contributed to lower CPI inflation. Core inflation, a better measure of underlying inflation as it excludes more volatile items such as food and energy, slowed to 3.9%, down from 4.2% down in March, and above expectations of 3.6%. While service inflation, another indicator thought to be a better measure of domestic price pressures, inched down to 5.9% from 6.0% in March.

Wage growth has softened, although remains high by historical standards and uncomfortable high for what the Bank of England would prefer. Annual regular pay increased by 6.0% over the three months to February and total pay by 5.6%. But there are signs that the labour market is cooling, with labour shortages easing steadily, unemployment and inactivity rising.

With inflation much closer to the inflation target of 2.0%, but easing at slower rates than Bank’s expectations, and persistent high wage growth, there are significant chances that we won’t see a rate cut in June.

UK wage growth has softened over the past few months, although remains high by historical standards and uncomfortably high for the Bank of England’s expectations. Annual regular pay increased by 6.0% over the three months to March and total pay by 5.7%.

But there are signs that the labour market is cooling, with unemployment and inactivity rising, employment falling and labour shortages easing steadily.

The economy turned a corner from last year’s technical recession and grew by 0.6% in Q1, above expectations of 0.4% of both the Bank of England and market analysts. Growth was spread across sectors, the only exception being construction. Particularly encouraging was the strength in services, seen as a sign that personal finances are improving. These figures prompted the International Monetary Fund (IMF) to revise their UK growth forecast for the year to 0.7% from 0.5% projected in May. Despite these better-than-expected numbers, their magnitude speaks of a prolonged stagnation for the UK economy.

To keep food and drink inflation moving in the right direction, we need a strong and resilient food and drink sector, that is not held back by muddled, costly and unnecessary regulatory burdens. ‘Not for EU’ labelling requirements for food sold in Great Britain is a perfect example. This unnecessary policy will require manufacturers to run separate production lines for EU and UK markets, have a chilling effect on our competitiveness, impeding necessary investment, reduce exports, and will cost the sector hundreds of millions of pounds. All of which will ultimately be felt in the pockets of shoppers at the till, countering the trend of declining inflation. These costs and burdens will be introduced at the same time as the second phase of the Border Target Operating Model comes into effect adding further pressures to the supply chain.